Content

If payment is not expected to be made until a future period, the Bank can elect to not automatically reverse the accrual. This account covers numerous items to be disbursed at a later date, such as amounts deducted from salaries for federal and state income taxes, United Way Fund, insurance, etc. Amounts charged to this account for equipment purchases or services must be for items received or services rendered and for which the Reserve Bank has a firm obligation outstanding. (See paragraph 11.56.) Obligations under lessee finance and operating leases are recorded at the commencement of the lease. Separate subsidiary accounts should be established to record obligations under lessee finance and operating leases.

Changes in interest rates may affect the volume of certain types of banking activities that generate fee-related income. The volume of residential mortgage loan originations typically declines as interest rates rise, resulting in lower originating fees. Banks tend to earn more interest income on variable-rate loans since they can increase the rate they charge borrowers, as in the case of credit cards. The first step, then, is that the public withdraws its deposits in favor of CBDC thereby draining reserves from the banks. This leaves the banks in a situation where their assets are funded by deposits and they have no reserves. The main objections to CBDC that the Fed’s paper raises are variations on these themes.

Bank Balance Sheet: Assets, Liabilities, and Bank Capital

However, when it comes to computing bank capital in today’s regulatory environment, all assets are not created equal. Regulators allow financial institutions to risk-weight assets based on their probability of default. Treasuries are considered the safest asset in the world, with a 0% chance of default (recent shenanigans in DC notwithstanding). Therefore, Treasuries have a zero-risk weight, which means that Treasuries do not count as assets for the purpose of calculating regulatory capital.

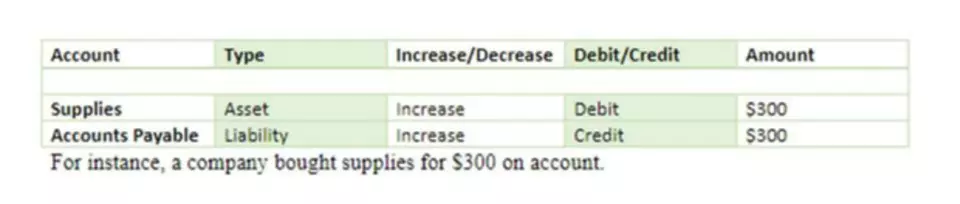

Now that you have an idea of how values are recorded in several accounts in a balance sheet, you can take a closer look with an example of how to read a balance sheet. In this article, we will discuss different scenarios to understand how values are reflected in the balance sheet accounts. According to the equation, a company pays for what it owns (assets) by borrowing money as a service (liabilities) or taking from the shareholders or investors (equity). The daily accrual is an automated entry processed by the general ledger application each night.

Balance Sheet Outline

Rather, this liability and related expense should be adjusted at year-end, to reflect overall changes in the level of the liability. This liability should also be adjusted periodically for significant changes in the liability that result from events such as merit increases, significant staff level changes, or policy changes. For example, when merit increases are granted to employees, an adjustment will be required to increase the liability. Districts that grant merit increases on an employee’s anniversary date should accrue the annual projected merit increase weekly ratably over the year in which the increases are granted. GSEs, such as the Federal National Mortgage Association, maintain redemption accounts with the FRBNY to cover maturing coupons and securities that are received by Reserve Banks for payment. Balances are maintained by the GSEs to cover the amounts that are due on any given payment date.

- The amount of this liability should reflect an estimate of the amount that will be paid, ultimately, by the Bank (net of stop-loss insurance, if the Bank maintains such coverage).

- Interest revenue captures the interest payments the bank receives on the loans it issues.

- This balance sheet sample shows different accounts reported and the layout of the document.

- Your GmbH or UG will exist ‘in formation’ until you have attended the notary appointment and entered it into the commercial register.

- “In general, if you’re trying to understand a company’s financial health, you want to review its income statement, cash flow statement, and balance sheet,” suggests Weiss.

- Separate subsidiary accounts should be established to record obligations under lessee finance and operating leases.

- Companies usually prepare one at the end of a reporting period, such as a month, quarter, or year.

Deposit accounts are also carried for purposes that are specific to only one or a few Reserve Banks. The individual account descriptions should be adequate to identify the different types of accounts maintained under this heading. For example, “Term Deposit Facility maturities” is a sufficient description, rather than Miscellaneous Deposit account 1, etc. In February 2012, the FRBNY acquired a building and transferred https://investrecords.com/the-importance-of-accurate-bookkeeping-for-law-firms-a-comprehensive-guide/ title to a newly formed and wholly owned subsidiary, Maiden & Nassau LLC, a limited liability company (LLC) organized under Delaware law. This account is used to record the investment in the LLC and is eliminated upon consolidation of the subsidiary. Special Drawing Rights (SDRs) are issued by the International Monetary Fund (IMF) to its members in proportion to each member’s quota in the IMF at the time of issuance.

Financials

For example, if a company has assets of $100,000 and debts of $55,000, the debt ratio is 55% ($55,000 ÷ $100,000). “In general, if you’re trying to understand a company’s financial health, you want to review its income statement, cash flow statement, and balance sheet,” suggests Weiss. “The combination of all three can give a better picture of a company’s financial health than any individual financial statement.” Hence, increasing asset velocity makes risk-weighted assets more productive. It combines the net effects from reducing capital drag on inefficient parts of the portfolio (such as low-quality loan books), adding fee income on syndication and securitization, and increasing the volume of new or additional business.

The account should not normally be used to adjust prior year income or expenses except for the correction of prior year accounting errors when the amount would seriously distort income or expenses of the current year. Entries to the account for prior year items may be made only with the prior approval of the RBOPS Accounting Policy and Operations Section. Since the Global Crisis, the size of central bank balance sheets has grown significantly.

It is not the intent of this manual to redefine basic accounting principles. In those cases where the accounting treatment is unclear, Reserve Banks should contact the RBOPS Accounting Policy and Operations Section for a FAM interpretation. Transactions of the Reserve Bank must be recorded in the general ledger and reflected on the Balance Sheet; none of the principles or possible lack of specific instructions for any given transaction in this manual should be interpreted as allowing otherwise.

- For instance when a bank offers a guarantee to another institution on behalf of their clients in which the credit transactions are not securitized.

- Our central point is that these five categories of operation exist, and that countries (or currency areas) need a regime for each one.

- The section on monetary policy implementation is about the availability of reserves, and, more generally, the interactions of CBDC funding channels with existing money-market instruments.

- This account consists of all present size currency held by the Bank, including currency held in off-site locations, regardless of the Bank of issue.

- These complex securities, along with other economic factors, encouraged a large expansion of subprime loans in the mid-2000s.

- Banks accept deposits from consumers and businesses and pay interest in return.

The difference between equity and other forms of bank funding is that equity is loss absorbing. Depositors and creditors have a contractual right to be paid back in full. If the value of a bank’s assets drops below its liabilities to creditors (debt holders) and depositors, the bank is insolvent. Equity, on the other hand, is not a debt contract, but rather the shareholders stake in the value of a company. In other words, unlike creditors and depositors, shareholders do not have a contractual right to be paid back their initial investment. Riskier assets like mortgage loans, corporate loans, and commercial real estate loans have a higher probability of default than the safest government bonds, and therefore have higher risk weights.

Assets: Uses of Funds

Equity capital gets depleted when banks take losses, and when it gets to be too low, banks have to raise more capital from shareholders. Silicon Valley Bank tried to do this, and when potential investors said no, it helped precipitate the collapse of the bank. But before digging deeper, let’s look at the liabilities side of the bank balance The Importance of Accurate Bookkeeping for Law Firms: A Comprehensive Guide sheet — that’s where you’ll find aggregated information on the bank’s deposit base. Clicking on “Total Liabilities and Capital” reveals the bank’s capital stack. Here’s how to find and download all those balance sheets, some basics about risk levels and resources to understand more about the risk of some assets versus others.