Whether you’re presenting in a monthly meeting to congregants or delivering financial presentations to the board or committee, it’s easy to create the right report for each audience. For tax reasons, everyone would love to declare their business a nonprofit, but there are strict rules around that designation. Terms, conditions, pricing, features, service and support are subject to change without notice. Religious organizations are generally, but not always, exempt from income tax.

Check out our accounting and bookkeeping services specifically for church organizations to learn about how we can manage your church’s accounts and provide financial insights to help you succeed. You can also use our in-depth requirements template to draft ideal software modules and compare them to this product list. Why do we recommend QuickBooks Premier — a desktop-based product — instead of cloud-based QuickBooks Online? Although you can employ workarounds to make QuickBooks Online work for your church’s accounting needs, QuickBooks Premier Plus provides industry-specific features like donor reporting and end-of-year donation statements. Your church has an important mission, and doing your bookkeeping shouldn’t get in the way. Using the right church accounting software helps you get your church bookkeeping done quickly and accurately, so you and your administrative staff can get back to the things that matter most to your ministry.

Raise the Standard of Financial Management for His Glory!!

This method is ideal if you don’t mind monitoring your funds and data from one location and license. PowerChurch Plus is available for a one-time purchase of $395 if you download the software, or $415 if you order a physical disk for installation. Upgrades are an additional $159 for downloads or $179 for physical media. Creating a business budget is an excellent first step for any new church.

- It differs from the income statement used by for-profit businesses, with a focus on financial accountability, transparency, and alignment with the organization’s mission and objectives.

- Offer payment options to donors, automate donations, and generate reports/charts and electronic receipts.

- Jo-Anne is a certified Sage Intacct Accounting and Implementation Specialist, a certified QuickBooks ProAdvisor, an AICPA Not-for-Profit Certificate II holder, and Standard for Excellence Licensed Consultant.

- These regulations can change throughout the years so it’s important to stay current on all annual guidelines.

- Sign up with FreshBooks to save an average of 16 hours each month and maximize the time you spend with congregants and community members.

- ChurchTrac, founded in 2002 in a Florida church, includes features for membership management, donations, check-in, worship planning, event planning, website management, and of course, fund-based church accounting.

QuickBooks can produce reports for a variety of purposes such as creating year-end donor statements, obtaining financing for new building projects, budgeting for church programs, and so forth. Free up your time from business and money matters so you can focus on helping the less fortunate in your community. With Wave you can connect your bank accounts in seconds for automatic transaction reconciliation, and make it convenient for people to contribute with online donations. Wave also uses physical and digital protection to keep the church’s money safe.

How is a church’s nonprofit accounting system different from a for-profit business?

You can add payroll processing for $40 per month, plus $6 per employee. Selecting the right church accounting software can be a significant asset to the financial management of religious organizations. By considering the listed factors, organizations can choose software that meets their specific needs and enables efficient and accurate accounting practices. This church accounting software is an on-premise, small-business solution for churches and nonprofits catered to bookkeepers, treasurers and accountants. This system also provides APIs to craft detailed integrations for technical developers. QuickBooks Premier Plus requires a $549.99 annual subscription, but nonprofit organizations can typically receive a discount if they purchase through TechSoup.

The proper church fund accounting software allows designated funds and undesignated funds to exist within the same system, but keep separation between them. Church accounting is quite different than its counterpart, for-profit accounting. The accountability principle in church accounting is called fund accounting. For-profit accounting doesn’t use funds since they are focused on making a profit only. Deciding whether to hire or outsource a church accountant is an important decision that can impact the financial management of religious institutions. There are advantages and disadvantages to both options, and the right choice depends on the organization’s specific needs and circumstances.

Benkorp’s mission is to:

We also have a breakdown of the pricing considerations and how to choose the right church accounting software. You can integrate Breeze with QuickBooks Desktop, or as this article on Breeze’s website explains, you can also make manual entries into QuickBooks — or https://www.bookstime.com/ any other church accounting software. Get started using best-in-class accounting software for churches with a free 30-day trial. FreshBooks lets you test out our easy-to-use features for a full 30 days before committing — no strings attached and no fine print.

Investing in new software can cost anywhere from a few bucks to $100,000 or more. You should also allot extra funds for unforeseen fees like implementation costs, maintenance, training and more. The idea is to find a solution that meets your needs and doesn’t make your wallet cry. Finally, Aplos Church Accounting Software is a cloud software designed specifically for small and medium-sized churches to help accountants, bookkeepers and more. FlockBase is an ERP for churches and businesses of all sizes, intended for accountants, treasurers and more.

Reports that are tailored and ready to share

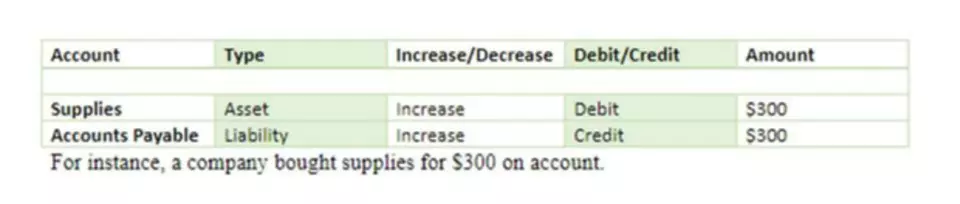

Fund accounting software uses one checkbook and has multiple funds keeping the money separated within that one checkbook. This allows for faster reconciliations, less paperwork, and less time needed to complete the work. Let’s use an example of processing a refund to see how easy it is to get a transaction wrong. Most of the time when depositing money into the bank account, a revenue account is used.

Church accounting software can significantly simplify the bookkeeping process for churches. The church accounting software solution you choose must evolve around the fund accounting system. For example, churches needing to track finances, manage donations and restricted funds and process payroll can buy accounting and human resource modules. Churches wanting to gain an understanding of and engage a large body of parishioners and donors can add a CRM. Finally, churches that sell merchandise, such as books authored by pastors, can add a commerce-ready ERP. The best church accounting software offers full accounting functionality at affordable nonprofit prices.

FreshBooks supports a wide range of payment methods, including simple online payment options. Give your congregation easy and flexible options for donations so they can choose accounting for churches the method that works best for them. The all-new Accounting Software from FreshBooks empowers churches to take control of their accounting and manage their finances with ease.

For example, grant money could be designated for a scholarship program. By understanding what sets church accounting apart from conventional methods, your organization can achieve both spiritual and financial success. We recommend churches like yours think long and hard about who will be best suited to handle the accounting needs of your organization. For the majority of small to mid-sized organizations, outsourcing your accounting needs is the best option.

An alternative to accrual accounting is cash accounting, which entails recording income and expenses when they are received or paid. However, some lenders require accrual accounting for their clients, including church clients, per Generally Accepted Accounting Principles (GAAP). QuickBooks for Church offers the ability to tag donor dollars for a committee, program or worship fund. The restricted fund dashboard gives the name of the donor, the ministry or project the donation is intended for, the donor’s contact information and the donation amount.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images. There are some useful tips that will make managing the church accounting system a little easier. These restrictions become the buckets that the money is separated into. Churches looking for an all-in-one church-tailored platform for keeping church records, managing church events and membership, and performing all essential church accounting functions should consider PowerChurch. Churches usually have tight budgets, which means fewer staff members.